It's important to understand who will receive a 1099-K, what it is for, and how you use it as part of your year-end process.

WHO:

You will receive a 1099-K from Amazon (and any other entity that processes payments for you like PayPal or a bank if you receive credit card payments directly) if you have over $20,000 in payments processed (not product sales) AND over 200 transactions for the year.

If you do not receive a 1099-K this does not mean that you do not have to report the income or that no tax is due. There are levels below which no income or self-employment tax is due but they are based on your entire tax picture for the year, not just your Amazon sales. If you are not sure about the taxability of your Amazon income it's best to speak with a tax professional.

WHAT:

Your Amazon 1099-K is an accounting of all money received by Amazon from your buyers and is just a summary of the dollars Amazon received for you as a payment processor (the same as what a bank would send you if you had your own merchant account for processing credit card payments). It is not adjusted in any way for fees paid, shipping purchased through Amazon, sales tax collected, reimbursements made to you by Amazon or any refunds issued.

HOW:

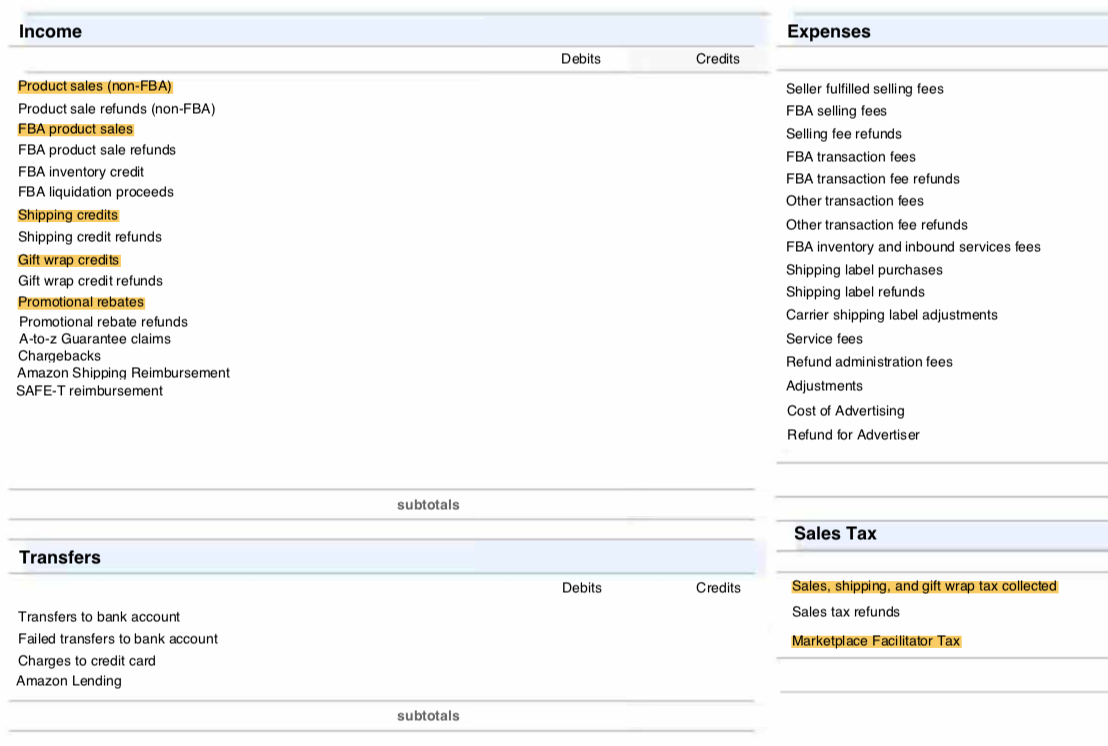

The best way to understand your 1099-K numbers is to run a Date Range Report in Amazon Seller Central.

Go to Reports > Payments

Click Date Range Reports tab

Click Generate Report > Select Summary > Select Custom > From: 1/1/18 To: 12/31/18

Click Generate. Wait a few minutes and click Download. (Please see sample report below.)

*If you add up all the items highlighted in yellow you should get your Amazon 1099-K total for the year.

*You'll notice Promotional Rebates and Marketplace Facilitator Tax are negative numbers so subtract them from the total.

Reminder: Promotional Rebates are credits given to buyers before they pay like free shipping on orders over $35 - the buyer is charged for shipping then credited back the shipping amount all within the one transaction so the shipping charge is included in your income but also taken out through a promotional rebate at the time of purchase.

Please Note: Amazon does not include the following

*FBA reimbursements for lost and damaged inventory in your 1099-K - you need to add this as additional income on your tax return separately from your 1099-K number.

*You will also have to adjust your return for sales tax collected which is included in your 1099-K number.

**Here is further guidance from Amazon Seller Central. Be sure to login to Seller Central and scroll down to ➞ Tax form 1099-K

Trying to understand your Amazon 1099-K?

Enter your information below and get our FREE guide Amazon 1099-K Explained!